Hybrid observability powered by AI for banks and financial services organizations: Top 5 challenges and how monitoring can help

Facing rising technical complexity and pressure from regulators, these are challenging times for financial services organizations. Given the near- and long-term uncertainties, organizations must focus on what’s coming next. That includes navigating technological disruption and the way it’s shaping experiences and expectations for employees and customers alike. Now, 73% of banking interactions happen over digital channels. At the same time, employees have grown used to engaging customers and colleagues across digital platforms spanning hybrid working arrangements.

Behind those experiences lie increasingly complex technical infrastructures characterized by factors like the shift to hybrid cloud environments and the unstoppable rise of generative AI. Existing legacy technology stacks and monolithic architectures are now the focus of large-scale modernization projects. And yet, while the use of digital channels continues to grow, customers are still demanding a level of personalized service, trust, and authenticity that only humans can provide. Digital channels should augment the physical — and that means striking an optimal balance between technology and people.

Ongoing disruptions facing the financial sector have inevitably led to new challenges. Modern technology projects, while vital, also increase an organization’s digital footprint — and its risks, unless the technology stack is properly implemented, monitored, and maintained. Keep reading to learn about some of the trends already driving change in the sector — and the big challenges that we need to address.

Banks and financial institutions are rethinking how they deliver services. With mobile banking now the norm and traditional brick-and-mortar banking relegated to a specialized service, institutions have to modernize and diversify to stay competitive. Banks must become more agile and adaptable to change.

Along with mobile banking, financial services institutions are using technologies like remote procedure call (RPC) and artificial intelligence (AI) to automate business processes like credit applications and routine customer service interactions. Moving to a hybrid cloud strategy drives improvements in agility, but it inevitably brings challenges as complexity increases.

Traditionally, financial services institutions (FSIs) used mainframes to deliver the computing power needed to manage large data sets and vast quantities of complex transactions. Then came the shift to public and private cloud architectures, such as data warehouses for storing structured data and large-scale data lakes for unstructured data. Now, these operations often span multiple clouds and third-party applications. Enter the era of the hybrid cloud.

While the benefits of hybrid cloud environments include enhanced agility and cost control, they also introduce complexity. Applications need to be modernized to run in such an environment, so they’re able to integrate data from multiple systems. This includes deploying containerized and serverless architectures to support agile development. While new technologies can deliver simplicity and customization for end users, they can create new problems and challenges unless IT is prepared to address the underlying complexities of these environments.

With cashless payments and consumers’ preference for digital services now well-established, FSIs are adopting a broader range of digital services to better accommodate demand. This has created massive opportunities for fintech companies, with neobanks now leading the charge with digital-first and cloud-native technologies.

Traditional banks and other established FSIs are trying to keep up, and many are partnering with fintech companies to enhance their service offerings. Fintechs continue to play a crucial role in helping existing FSIs retain clients, break into new markets, and deliver new services in less time. What used to take a bank several years to deliver can now be produced in months by partnering with the right fintechs.

Financial services operations traditionally revolved around rigid systems and policies that left little scope for customization. But today’s customers are used to having greater flexibility and more choices with regards to how they configure and use their products and services. They expect the level of personalization that only technology can support.

Generative AI is radically transforming the industry by offering personalization at scale, whether it’s improving customer interactions or streamlining employee workflows. In addition, predictive AI is advancing rapidly, allowing FSIs to mine historical data on consumer behavior to better tailor services to the needs of specific customers, rather than adopting a one-size-fits-all approach. They’re also feeding this data into bespoke conversational AI models for handling routine queries quickly and effectively, whether those interactions take place on web apps, mobile apps, or through email or text.

FSIs face an increasingly broad set of challenges driven, in a large part, by advancements in technology and the evolving customer and employee expectations that come with them. After all, it’s much easier to lose sight of mission-critical systems and data when your environment spans multiple clouds. The demands of cybersecurity and regulatory compliance are growing rapidly too, further challenging FSIs to maintain complete observability and control over their digital assets.

Here are some of the biggest challenges FSIs currently face.

Given the rise of neobanks and other fintechs, it has become harder for established FSIs to retain their customers. Younger customers want convenience and a personal touch — customer experience is key to maintaining loyalty. Some of the trends we highlighted previously are key to maintaining this loyalty. Providing options like chat interfaces during onboarding or account management features can go a long way, but they need to be available and fully functional at all times.

Banking no longer happens only on Monday through Friday from 8am to 5pm. Today’s customers now expect solutions around the clock on any day of the year. For example, if someone sees fraudulent activity on their account on a Sunday evening, they want to be able to address it instantly. The same goes if they want to report a lost or stolen payment card. Customers also expect the ability to make money transfers 24/7 — in the US, the new FedNow Service infrastructure, launched in 2023, makes that possible. It’s time for FSIs to get ready.

With hybrid work arrangements and multi-cloud architectures now the norm in financial services, teams often end up operating in isolation, using different tools and processes in their day-to-day workflows. Visibility is becoming increasingly fragmented, and that makes it harder to effectively identify and diagnose issues, like potential security risks or compliance failures.

Technical siloes exacerbate organizational silos, also leading to barriers to collaboration and productivity. This puts strain on communication between teams and departments and reduces the quality of data-driven insights and decision-making. Siloed operations also slow progress towards broader business initiatives, making it far more difficult to implement new technologies without adding unacceptable risk.

Competition in any industry can be helpful in driving self-regulation and innovation. On the other hand, competitors typically drive down pricing to the consumer and improve things like customer service in order to win business.

Unfortunately, competition can also lead to instability, and in a sector like banking, this can be very troublesome. Quite often, banks simply can’t be allowed to fail, and the burden of keeping them afloat during periods of severe economic downturn falls to the taxpayer.

Newer FSIs, such as neobanks, are choosing to prioritize online services and more attractive interest rates over providing a physical presence on the high street — and they’ve proven very popular. Many offer integrations with popular money management and accounting platforms as well, helping their customers to simplify their finances. FSIs like Revolut and Wise offer customers access to foreign currencies with no charges as well as the ability to move between international currencies with minimal costs.

As one of the most regulated industries of all, financial services are no stranger to stringent compliance mandates. The financial crises of 2007-2009, 2020, and the economic impacts of Russia’s invasion of Ukraine have put enormous pressure on the regulatory landscape. Banks need to rethink how they manage their liquidity and determine which assets need to be kept in reserve to maintain financial stability in future crises.

Ongoing technological disruption has also prompted regulators to again review processes. An example is the rise of off-channel digital communications in financial services, with Wall Street firms recently racking up over half a billion dollars in fines for using unregulated messaging apps to discuss business.

Another regulatory framework on the horizon is Basel III, which sets the minimum operational restrictions and requirements for internationally active banks. Other regulatory developments include the revisions to Consumer Due Diligence (CDD) rules and proposed changes to mitigate oversight in automated valuation models (AVMs).

The trend of migrating to modern computing architectures, such as hybrid cloud environments, enhances agility and helps support a broader range of customer and employee needs. But the complexity of these technologies makes it harder to retain control and observability over increasingly disparate systems.

Mitigating the risks that come with greater complexity can be expensive and time consuming. Processes must be redesigned, applications and infrastructures rearchitected, and numerous sources of data consolidated. All the while, FSIs need to ensure they’re staying compliant with regulations — there’s valuable intellectual property and customer data embedded in these systems that needs to be protected.

Building a strong financial business case for any hybrid cloud migration is vital for keeping costs under control, mitigating risks, and enhancing business processes.

The banking and financial services space has the most to gain by accelerating digital transformation — but it often has the hardest time doing it in the wake of constantly evolving security and regulatory demands. To innovate without adding risk, it’s imperative to maintain full visibility and control over your technology assets, no matter where they reside or the systems and vendors they depend on.

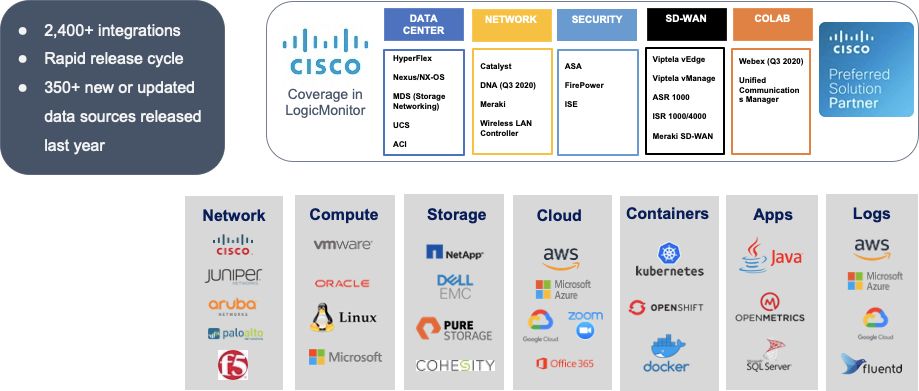

LogicMonitor uses agentless technology to consolidate your computing infrastructure under a centralized dashboard for monitoring and complete observability. Here’s what that means for your business:

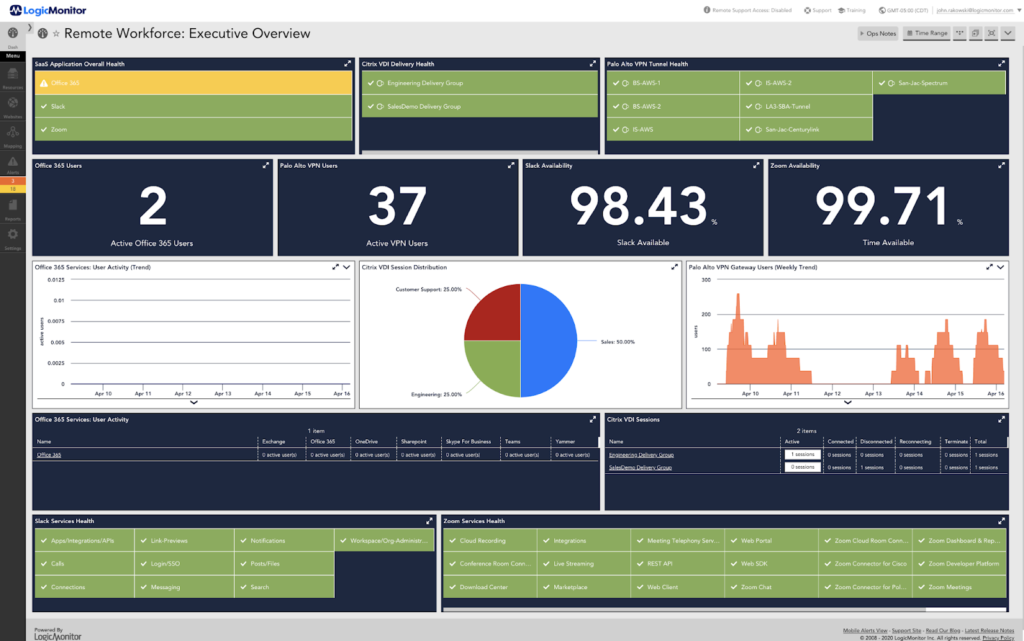

Financial services firms must be fully committed to delivering dependable, secure, and outstanding customer experiences across their digital platforms. LogicMonitor helps make that possible by simplifying and consolidating the management of user-facing systems, giving companies a comprehensive view of their applications and platforms.

This extends far beyond traditional legacy systems and monolithic architectures to span modern, hybrid-cloud infrastructure. With the right observability tools, you can integrate data across systems to ensure customers enjoy a seamless transition among the digital channels they use to engage with your services.

With greater visibility, data becomes exponentially more powerful as a resource for helping you understand how your customers engage with your applications and services. By enabling seamless monitoring and observability across hybrid cloud environments, LogicMonitor brings data and insights together, giving decision-makers all of the information they need to improve customer- and employee-facing services.

For financial services firms hoping to accelerate their DevOps initiatives, cloud migrations, and modernization efforts, LogicMonitor provides turnkey support for almost any new and existing technology. With sophisticated and customizable visual dashboards displaying things like host maps and service maps, developers can gain granular insight into their application architecture and resource usage.

LogicMonitor automates the discovery of assets like virtual machines, databases, applications, and services even in the most complex hybrid cloud environments. Organizations can maintain visibility into both legacy technologies and new cloud infrastructures, simplifying the consolidation of performance metrics and providing real-time visibility into every aspect of your computing environment. That way, you can make data-driven decisions and prevent innovation from increasing risk.

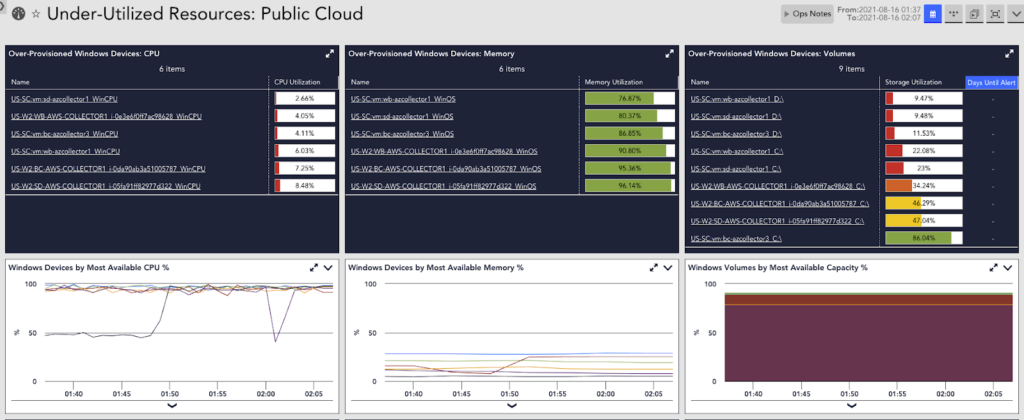

LogicMonitor allows businesses to monitor their cloud workloads as well as their on-premise infrastructure. It’s also great for tracking the transition between the legacy stack and a newly migrated cloud environment. LogicMonitor leverages things like automated tags with property sources to make it easy to track virtual machines as they move to the cloud, so you can continually optimize your deployments and provision resources more efficiently.

With complete observability, FSIs can address the complexities of working across hybrid cloud workloads, including breaking down silos between data and teams and regaining control over costs and usage. Decision makers will know instantly if any migrated virtual machine or other resource is costing more than it should by pinpointing those that are underutilized. This supports rightsizing of cloud workloads, allowing you to strike the perfect balance between cost and end user experience.

FSIs build their reputations on trust, and organizations must place security at the forefront of cloud migration and other technology projects. LogicMonitor helps enhance security for your data systems in a host of ways, including:

● Secure architecture: Role-based access controls (RBAC), two-factor authentication (2FA), and encryption of data in transit and at rest

● Secure data collection: The LogicMonitor collector allows outbound communication only, and data is encrypted using transport layer security (TLS). All LogicMonitor collectors are securely locked to the environment.

● Secure operations: Collectors based on hardened Linux with perimeter and host-based intrusion prevention system (IPS), operated out of top tier domain controllers and AWS regions, all with top security measures in place

● Secure practices: Minimal personal data stored, device access credentials stored in memory and never written to disk, and salted one-way hashes used in place of user passwords

● Secure standards: Constant penetration testing ensures maximum security, and SOC2 compliance validates our controls for security, high availability, and confidentiality.

Using a secure proxy, operations teams also retain full control over their communications, allowing users to lock down traffic out of their networks and minimize exposure to external threat vectors.

Banks used to be able to rely on having customers for life, but that’s no longer the case with younger generations. The ability to personalize banking services and provide clients with custom solutions has already proven essential in attracting customers and discouraging them from changing suppliers.

But the FSI sector is now very much a buyer’s market — it’s an exciting time to be involved in banking, especially as we enter a new industrial revolution driven by cloud computing, AI, and automation. The rapid pace of development undeniably introduces challenges, but those challenges are really just opportunities in disguise.

By providing one platform for observability across your entire environment, LogicMonitor helps you overcome complexity, maximize service availability, and mitigate security and compliance risk. LogicMonitor can help your financial services firm achieve these goals — learn more in our case study showing how fintech company Abrigo achieved a 99.99% service uptime.

© LogicMonitor 2026 | All rights reserved. | All trademarks, trade names, service marks, and logos referenced herein belong to their respective companies.